The Trappings of Success

Success does not come easy and when we have it, we ride it for as long as we can. Whether it is a great product, highly effective business model, widely revered purpose, or creating extraordinary relationships, we make every effort to keep it going. We handle the other aspects of the business, but the majority of time and resources are spent on what has made us successful. The singular focus can make your success a trap.

Competition is much more complex now. You have to excel on multiple fronts. Not only to maintain a power position within the market but also making sure the business will be around for a long time. Nurturing a culture focused on only one success factor depletes the capacity to innovate. Overtime success factors fail to be of use to you and are rarely of any use to other organizations. The world always moves on.

Separating Ideas from Ideation

Patrick Van Der Duin makes a strong argument against using success factors[1] to drive change. Leaders must separate innovative products and services from the innovative processes that created them.

Innovation management that started in the 1970’s turned business innovation inward. Stagflation required a focus on increased efficiency and cost reductions. The sentiment of that time still has a hold on business today.

I believe the same thing that keeps people singularly focused on what has made them successful is the same thing that keeps them from escaping their current demise. It is the lack of curiosity and the inability to follow through on ideation. It is also the inability to align the creative process towards objectives that can better reposition the company.

Intentional Strategies

Many organizations suffer from the lack of strategic intent. Even though productivity efforts like Lean and Six-Sigma are promoted as strategies, they fail to satisfy the criteria to even be a framework for strategy. Below is a list of what I consider other false strategies:

- Stringing a series of loosely related initiatives together. Some call this ‘cherry picking’, ‘low hanging fruit’, etc. It feels good but doesn’t better position the company.

- Settling for a cross-functional planning process like S&OP. Planning is not strategy.

- Using a goal or objective to drive wholescale change. These are the worst use of success factors to drive change. No one measure is good by itself. There needs to be a balance.

- Taking a ‘copycat’ approach, especially without understanding why. The Lean cottage industry uses stories of success from other companies that only relate in very general terms. Using this approach creates resistance.

Overplaying Your Choices

There is also the tendency for leaders to stretch their current strategy too thin. Instead of putting the work in to develop strategic choices, they dedicate time and resources on an indefensible position. Because strategy is observable, it does not take much effort to see if what you intended actually happened. Yet few leaders will do it.

In recent articles I walked through the strategies I have observed from Dr. Pepper Snapple Group, Wiremold, and Ford. What I found was the intent they publicized did not support the strategy they ended up with. In one case, leaders slapped a pop label like Lean on their initiative to increase buy in from stakeholders.

You must keep fueling the economic engine that makes a company successful but also leave enough in reserves to encourage ideas of something better. Goals of efficiency and effectiveness must be applied to innovation management in addition to processes. There must be a balance.

Balancing Innovation and Driving Ideas to Profitable Outcomes

We know that businesses can exist for hundreds of years[2] and while it is useless to adopt their success factors, knowing longevity is possible should encourage leaders to look over longer time horizons. Chances of viability are improved when organizations can adopt a variety of approaches and reconfigure assets, capabilities, and resources in advance of changes in the market. In order to do so, leaders must think in terms of different time horizons.

Planning beyond 10 years may seem futile but considering how decisions will age is different. Alexander Rose thinks in terms of pace layers and how organizations can be mapped across them[1]:

- Fashion

- Commerce

- Infrastructure

- Governance

- Culture

- Nature

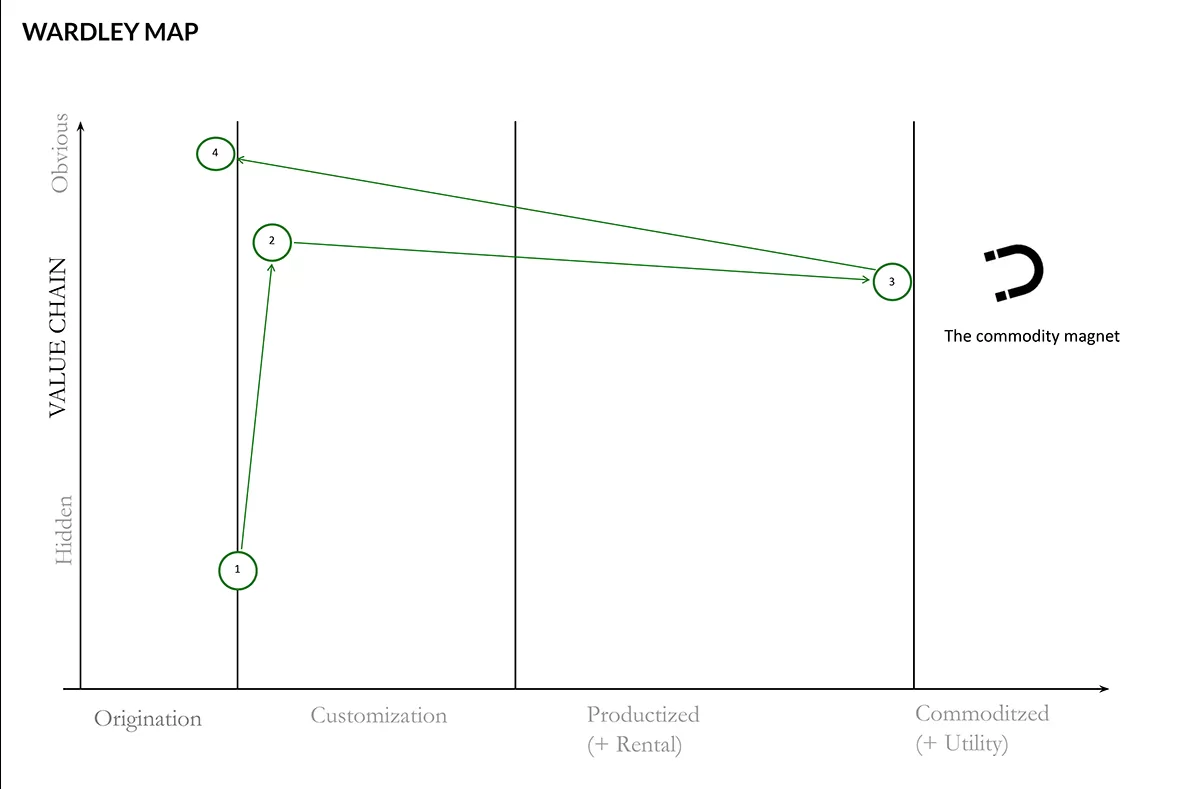

When I introduced the Wardley Map in the previous Quarterly Insight, it occurred to me the map stops at the ‘Infrastructure pace layer’. What would the value chain analysis look like if we extended through governance, culture and nature? How can the pace of government, society, and nature affect our decision-making?

Success factors are empirical and are a great way to explain how you succeeded. Yet, past factors do not help your current situation. Circumstances and context constantly change. Technology advances and people come and go. It is the search and adoption of new factors given the current situation and context that cultivates success.

A Case in Point – McDonald’s

The McDonald’s brothers were in the right place at the right time when they opened their restaurant in the 1940’s. Social mobility was on the rise and conveniently prepared food fit right in. Hamburgers, sodas, shakes, and chips were just what American’s wanted.

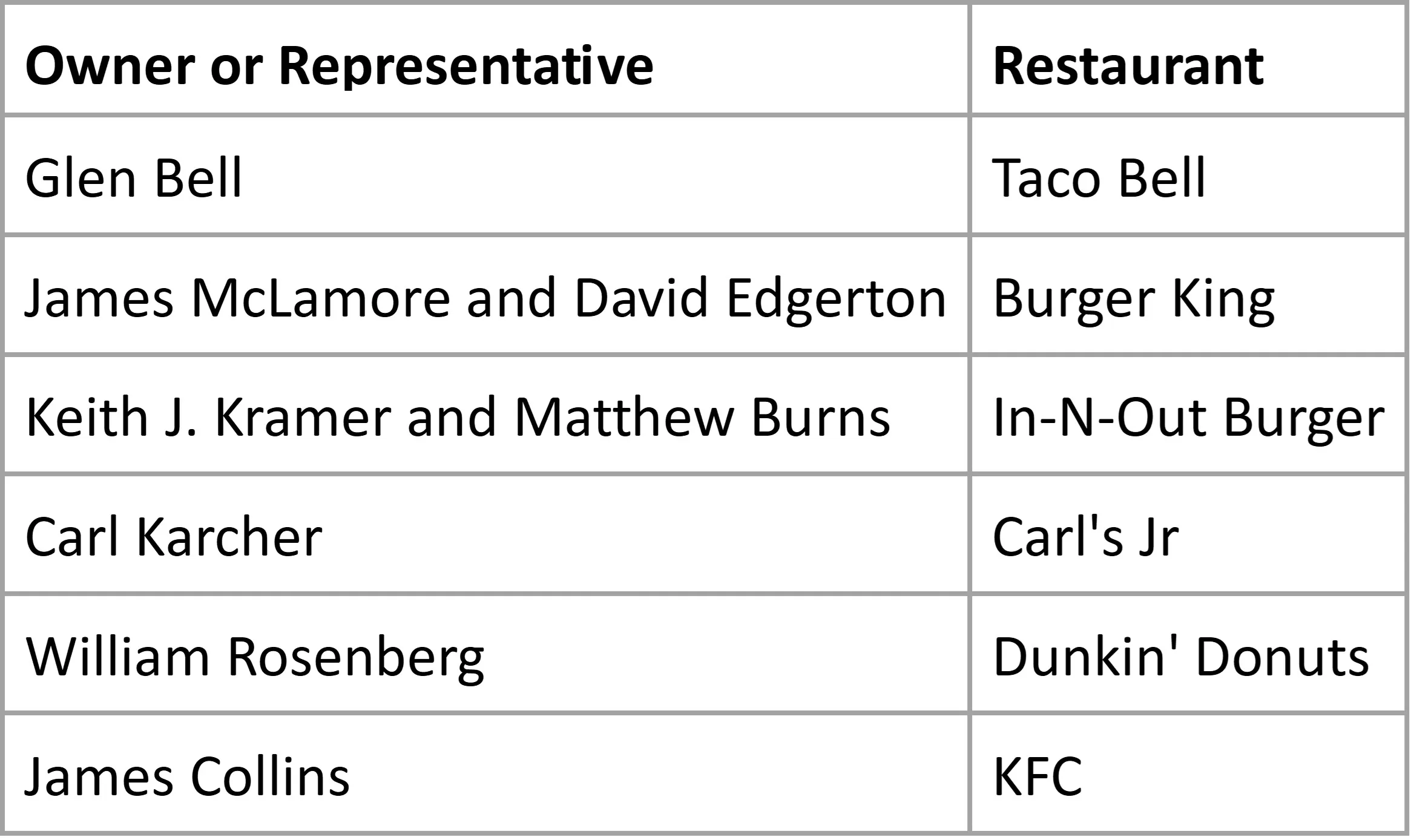

The brothers took what I consider an industrial engineering approach to their kitchen. They put the ‘fast’ in fast food. The brothers had a great system and wanted to share what they developed. In doing so, they were creating the very competitive landscape that just might jeopardize the brand’s viability. Table 1 is a list of the restaurant owners who studied the McDonald’s ‘Speedee Service System’ in the early years.

When Ray Kroc took over, he went all in on standardization. Even at a feverish pace in which Kroc standardized equipment, processes, and ingredients, his productivity gains couldn’t outpace his rivals. It was his rapidly increasing the brand’s footprint before any rivals that anchored McDonald’s in people’s minds.

A Sign of Inertia

McDonald’s purpose, brand identity, business model, and innovation strategy are tightly integrated. Something organizations have a tendency to do if they lack the ability to innovate. If businesses are too tightly integrated, they squeeze out the ability to innovate where it is needed most. The extent of McDonald’s innovation seems to be the introduction of Limited Time Offers (LTOs). New but not original.

Studying McDonald’s strategy, we see an overreliance on operational efficiency that keeps them from creating long-lived favorites. Eight to ten items introduced decades ago make up sixty-five to seventy percent of today’s total sales.

Clues

McDonald’s is doing quite well. Yet, there are some recent signs that together may suggest a bigger problem:

- Krispy Kreme recently ended their partnership this year because they were unable to achieve sustainable results[3].

- Reintroduced snack wraps after 9 years as a permanent menu item even though it was discontinued due to the complexity to make and lack of sales[4]. Their innovation strategy requires something ‘new’ a couple of times a year to keep sales going.

- McDonald’s was rated with the lowest customer satisfaction score recently. A 1% decline from last year[5].

- Chick-fil-A’s sales per store is nearly twice that of McDonald’s ($7.5M to $4M)[6]

- Recent health focus on removing artificial & synthetic flavoring and coloring puts fast food in its crosshairs[7]. McDonald’s French fries started out with 4 ingredients and now consist of 19[8].

I am not arguing about McDonald’s success. Most everyone is aware of the Ray Kroc story, and I too am very impressed with what he accomplished. Yet, have they stretched their strategic choice too far?

Things to Consider

Continued success requires an adaptable approach. One that begins with awareness of your situation and its context. Not only will an adaptable approach help create your own success factors, it is also scalable.

Even from an enterprise perspective, the situation and context are still the first considerations. Here we think in terms of strategy and value chains. Does the demand side of your value chain capture enough customer insights? How much does the supply side of your value chain rely on commodities or your network? Have you sufficiently leveraged your unique way of creating, delivering, and capturing value? What effects do your industry, strategic choices, functional dominance, offerings, organizational design, and leadership have on your brand (Understanding the Influences that Impact Your Company’s Brand – Driscoll Solutions)?

McDonald’s Adaptability

McDonald’s must use their experience within the context of the fast-food industry. I believe they are on the cusp of being a commodity. See Figure 1 of a plot of their history using a Wardley Map. Circle 3 may be where they want to make their stand, but it is a different kind of existence.

The path of McDonald’s over the decades on the Wardley Map:

- The began as a unique customization of grilling; they provided good food fast

- The popularization of the McDonald brothers “Speedee Service System” moved them into a more obvious position. McDonald’s created fast food and enabled industry competition.

- Soon after Ray Kroc took over the business, his drive to standardize processes and the modification of ingredients, quickly grew McDonald’s with only a limited menu. Over time they became one of many fast food restaurants to choose from.

- McDonald’s will need to go way beyond its current menu innovation strategy if it wants to maintain a dominant position in fast food.

Opportunities and Capabilities

A large part of success is finding a way to keep delivering as economically as possible. It can be along the lines of customer intimacy, product leadership, or operational excellence. However, the more your business system is tightly integrated around that one way, the more you shut out the ability to innovate.

Competing along multiple fronts requires innovation anywhere along the value chain to satisfy unmet needs. The more you use existing capabilities to pivot or shift, the faster you can respond. My rule of thumb is if you don’t have at least half of the capabilities needed, you might want to look somewhere else on the value chain for opportunity. Requiring too many new capabilities is not much different than creating a start up.

The lure of productized solutions is they promise a standard way to improve and automate your business system. What you may not find out until it is too late is the more you buy into a pre-packaged solution, the more trapped you become. Not only that, but a great deal of time and resources will be spent on modifying the framework to fit your situation and context.

Look for the Signs of a Trap

Take a long hard look at your strategy. Does it still apply given the current situation and context? Some things to consider:

- Do your responses to changes in the market match the type of expectations? For example, do you improve quality or pricing when customers are looking for a specific set of characteristics and features.

- Do customers say your products are over-loaded? For example, do you have more characteristics and features than customers want to pay for.

- Do you keep coming up with new products or services that get a partial response from the market? This could mean you are reacting versus leading. It could also mean you don’t fully understand customer needs and where you can best interact with their lives.

- Does the market identify with your company in the same way your employees do? If not, it could mean you have either lost your way or are too rigid.

One sign that McDonald’s has been trapped by its success was when Subway started taking market share away. It wasn’t just about healthier options. It was the fact that society once again moved on. Chick-fil- A is the newest sign that McDonald’s should not ignore.

Point of No Return

It is ever too late for any going concern. Strategic discussions should be about finding a way back to an authentic state of origination. Even those like McDonald’s that have a wholescale[9] approach can find a way to offer something that meets the market where it is. Fast food is full of companies jockeying for market share and are all susceptible to startups that offer new unique experiences.

People, cultures, and markets are creatures of habits who adapt at will. The greatest challenge for leadership is to continually align the patterns of behavior of their people and cultures in response to the ever-changing needs of the market.

[1] van der Duin, Patrick “Contextual Innovation Management: Adapting Innovation Processes to Different Situations”, The Generations of Innovation Management, Taylor & Francis, 2020, pgs 36 – 52. [2] https://medium.com/the-long-now-foundation/the-data-of-long-lived-institutions-4e7743c95f07 [3] https://www.foxbusiness.com/lifestyle/mcdonalds-krispy-kreme-end-doughnut-partnership [4] https://www.foxbusiness.com/lifestyle/mcdonalds-confirms-permanent-return-snack-wraps-menu-favorite-returns [5] https://www.foxbusiness.com/lifestyle/fast-food-giant-maintains-iron-grip-customer-satisfaction-amid-restaurant-industry-changes [6] https://www.eatthis.com/chick-fil-a-sales-rising-2024/ [7] https://www.foxbusiness.com/lifestyle/report-ranks-top-10-unhealthy-fast-food-chains-us [8] https://youtu.be/je04_csRd6s [9] A term I first read about from this Hilton Barbour interview: https://www.linkedin.com/pulse/culture-transformation-balancing-discipline-curiosity-hilton-barbour/