Engaging Inflation and Staffing Issues

Consistency in the US economy as we knew it has given way to a new normal. Employment trends and inflation are not consistent within or across most industries. Labor is a mixed bag of shortages and overstaffing. Inflation keeps rising even though the cost to borrow keeps increasing. Perhaps this inconsistency is what is keeping the economy chugging along; a portfolio of counter-cyclic producers, if you will. As the risk of a recession recedes, this is what we are left with… for now.

Let us look at each of these topics in more detail:

Inflation

There is too much money in the economy, or so the Fed believes, but it isn’t equally spread out. The asymmetry of cash reserves is allowing some businesses and consumers to keep spending while causing others to pull back. Inflation is still persistent because there are enough buying goods and services at inflated prices. For example, retail sales continue to trend upwards: See US Retail Sales by YCharts

The effects of shrinking the money supply is making borrowing more difficult. My sources in the banking sector are recommending that organizations open or expand their lines of credit, even if they don’t need it now. With financial institutions receiving stricter capital requirements, coupled with fewer dollars available, being able to increase credit limits in 1st quarter 2024 might not happen.

Hospitality and home improvement are settling into their long-term growth trajectories after the pandemic slump and bump. There are several industries that need to get back to a normal pattern of sales. Until then, not every industry will see growth or even shrink; experiencing their own stagflation. To add to the complexity, even if a whole industry is trending up or down does not mean there are not several companies who are seeing the opposite.

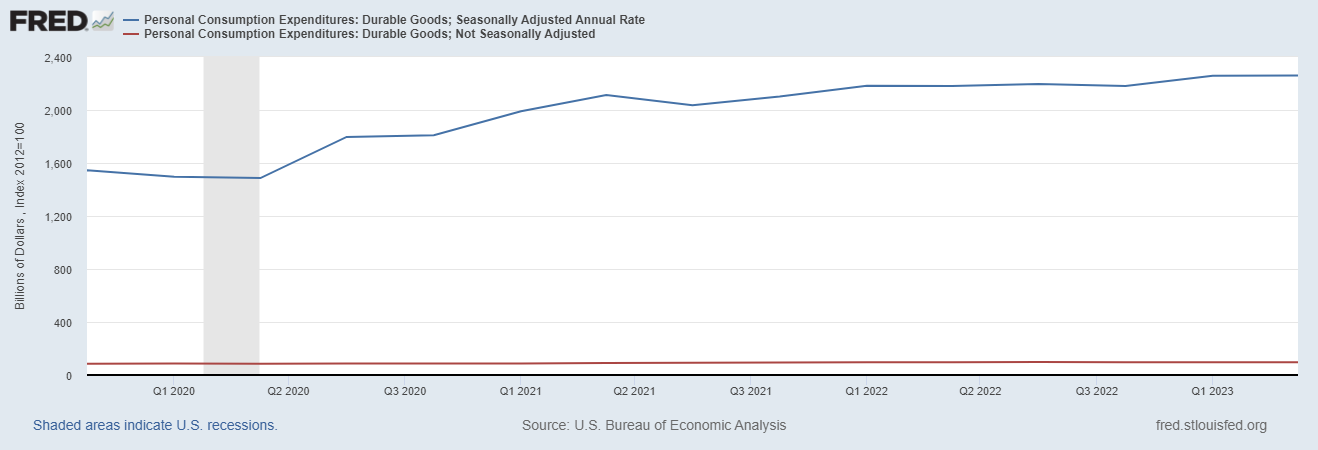

For example, metalworking continued to contract through August yet durable goods are performing consistently. As we look broader across the manufacturing sector we see many jobs going unfilled. Metalworking Activity Continued to Contract Steadily in August With inputs into the durable goods sector seeing a reduction of demand, the sector itself has seen consistent consumption:

What to watch

China is in a serious slowdown and US consumer credit card debt is well past the trillion dollar mark with household debt at a record $17.06 Trillion (See the NY Fed Aug 8th Press Release) From the press release, note that the increase in reported auto loan amount is not due to originating loans; fewer loans used to purchase elevated car prices. Just another example of economic contradictions we are facing.

Additionally, bankruptcies are on the rise. Corporate Bankruptcies On The Rise. HBO started streaming in 2010; the largest year for number of bankruptcies in the past 14 years. MGM and Blockbuster both filed for bankruptcy in 2010. Sixteen bankruptcies worth over a billion dollars in 2023; BB&B and Silicon Valley Bank.

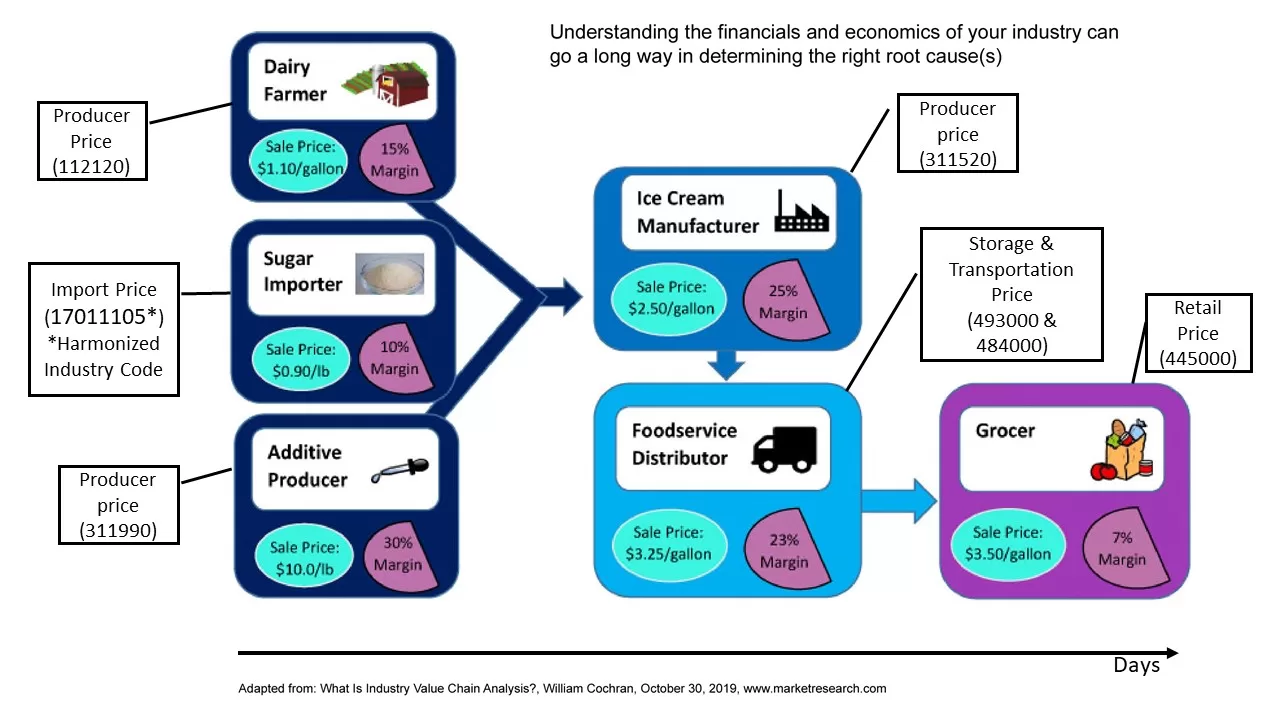

Just watching overall economic indicators is no longer sufficient. Business leaders must not only understand the economics of their industry, but they also need to measure trends. Customers, suppliers, competition, and substitutes can provide clues, but qualitative understanding is not enough.

A basic depiction of the US economy helps remind us the flow of value and inter-dependencies that exists across sectors and industries. What does your value chain look like?

Employment

The convoluted spending and inflation across industries and companies has led to a strange employment landscape. Some industries are finding it difficult to hire while others are laying people off. (See Forbes’ article on Labor Market Slowdown) . It truly is a mixed bag of labor needs across and within industries

Finding employees if you are in an industry experiencing a shortage will require innovation in sourcing and training. The balance is employee capability versus what it means to be fully staffed. For decades, organizations categorized their positions along the lines of education. We have recently seen a push for vocational training instead of a 4-year degree. The question of what is it about a 2-year degree that disqualifies a person from becoming an executive, now should be addressed. This article speaks to just that; hiring non-bachelor degree holders for traditional bachelor degree jobs: https://hbr.org/2023/03/the-new-collar-workforce

As one executive states:

The issue is that most of our plant level employees will never relocate for a job. They are more connected to a location, region and family. This also means, they are less likely to relocate between plants or locations in a company and leave the company for another opportunity. This is different than in the past where people would put the company first and then life second. This has completely reversed. I have many employees who when given a larger job at another location turn it down and want to be promoted in location. Therefore, I am less likely to even relocate a new hire who gets home sick and just goes back from where I hired them for. I will however offer a relocation package for an internal person who is the rarity who will move their family for the company and opportunity. So in short, relocation for internal employees – yes. Relocation for new employees, unless they are a very big hire, unlikely.

In today’s new normal leaders are putting more effort into keeping the good people they have because employees want to stay close to home and the current dynamic environment can easily burn people out. Another executive hesitates to add more to his team’s workload because he doesn’t want them to quit. This in spite of the fact that they are only working to keep their heads above water. My work with him on developing a strategy is delayed two months while he and his team complete twelve big projects that are critical to keeping the business running.

What to Watch

Wage compression is a risk to those industries struggling to find enough labor. Hiring less experienced or less qualified individuals at a higher wage than the ones who have stayed with you, could cause problems down the road. Don’t let old rules of time in position or pay bands keep you from compensating employee loyalty and performance.

Greater awareness around factors that lead to opportunities and threats. Cost of hiring as an example. Will full package relocation start being offered again? Things to keep in mind are the low inventory of homes for sale, elevated interest rates, RTO requirements, shortage of workers within some industries. Not to mention the observation that many may not physically relocate for a new opportunity. This could considerably reduce the number of businesses looking to steal your employees away. Understanding not only the risks but the sensitivity of factors helps tremendously in avoiding surprises.

Things to consider

Strategy and innovation are your best bets now more than ever. While many believe developing a solid strategy in spite of turmoil or a dynamic environment is not possible, they couldn’t be more wrong. Strategy is about creating customers. It involves performing different activities or doing the same activities differently or both. By focusing on what drives customers’ behaviors, leaders can then marshal the needed capabilities and modify their organizational design to create the product or service that is required.

Automation to enhance employee efforts versus replacing people all together. Now would be the time to identify areas for automation. Whether it is Robotic Process Automation (RPA) or AI for the office, helping employees become more effective is the best play. Not only will it make you less dependent on a tight labor market, but it will elevate the capabilities of your organization. Automation for the industrial sector increases safety, productivity, and allows employees to focus more on innovation. The sooner you get started on any capital expenditures, the sooner they will achieve zero book value. The good news is technology is very scalable with short-term payback in most cases.

For more thoughts on taking better control of your organization read Leadership, Capabilities, & Strategy or Understanding the Influences that Impact Your Company’s Brand