Four Factors to Consider

Each quarter I pick a handful of indicators I believe will help point to where opportunities lie for individual firms. They may be economic in nature, but I find their best use is as an outward look from a specific company. They have been helpful in guiding leaders in looking inward at what capabilities are needed to better compete. For more on inward reflection see my article: Understanding the Influences that Impact Your Company’s Brand

As many strategy experts have noted, leaders must balance squeezing every bit of potential from value creation activities and resources to identifying choices and being ready to take advantage of the best opportunity. Roger Martin says there must be a balance between explorative and exploitive efforts[1]. I have found that using key outward measures as leading indicators helps keep a healthy balance.

The factors I watched in the 1st quarter and now going into the 2nd are productivity, mergers and acquisitions (M&A), AI, and US monetary and fiscal policies. These indicators are useful individually but when compared to capabilities within a specific organization can help leaders make better strategic choices.

Productivity

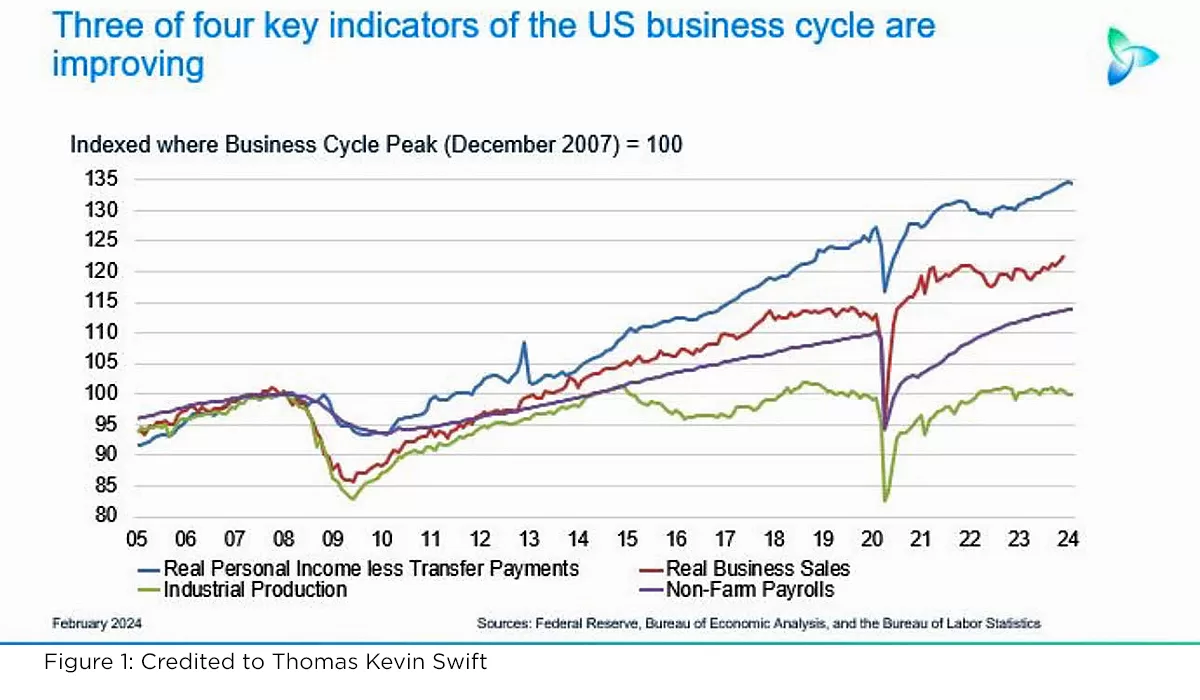

Many look to consumer spending as an economic indicator. Productivity is a better measure because the market only builds in anticipation or knowledge of increases in demand. It is more of a leader indicator. Thomas Kevin Swift writes often on the subject. He uses business cycle indicators to decide what phase the US economy is in: expansion, peak, decline, trough, recovery.

In 2023 we were experiencing rolling recessions in industrials, technology, and consumer and services[2]. Some industries are still in the recovery phase, such as commercial real estate (CRE). Understanding what is holding back expansion and driving growth can better prepare leaders for decisions such as building or leasing.

Merger & Acquisitions

As part of the recovery process after a downturn, a clearing of an industry can take place. I am using mergers and acquisitions (M&A) as a signal of repositioning for growth. This can either be in revenue or profits.

There are several reasons for increased M&A activity. One being regulations. One third of independent banks were lost to M&A after the Dodd-Frank law was passed[3]. Another reason for business consolidation is innovation. As an example, we saw this when movie theaters went digital. Smaller businesses could not afford the upgrade to modern technology. Affordability would not be the driver of consolidation, but rather those firms that can effectively and efficiently integrate the technology.

The Problem or Opportunity That Will Attract AI as a Solution

An executive recently told a story of how he created a corporate wide announcement with the help of AI. The normal process is to write a draft, then send it to the communications department for a final copy. When he sent the AI enhanced memo, the communications department approved it without revision. So, does the company still need a communications department? Yes, they do for several reasons, in addition to the fact the department does more than ensure memos follow corporate policies.

The first reason is consistency in messaging. Given AI platforms are ever evolving, there is no guarantee the system will use the same tone, voice, or guiding principles in later messaging. A second reason is alignment with corporate values and principles. It may have been coincidence that the output of the AI system’s algorithm fit within the guidelines of the CEO’s company.

This scenario highlights the gap between the potential of AI and its ability to reliably work with a specific organization’s needs. What is developing is an intermediary market consisting of subject matter experts (SME’s) who have become adept at prompt engineering. There are several things that hinder progress in integrating AI, one being digitalization. Digital transformation, the ability is a cottage industry itself, needs to make more progress before companies can take full advantage of AI. Even considering the potential of AI, there still is not a technology creating an attractor state indicating which direction any industry will evolve[4].

It is too early to tell but I believe these AI startups fall along the same functional lines you will find in medium to large companies; marketing, communications, engineering, process improvement, etc. I do not know how developed this market will become before mid- to large companies bring the capability in-house.

We have yet to see anything that signals AI adoption is causing a competitive advantage within any industry. In March of 2023 Rob Porter predicted that marketing, banking & finance, healthcare, and transportation would make the best use of AI[5]. Not much on industry trends for 2024 and an article by MIT Sloan Management Review does not mention industry advancement. The article reports progress being made in the components of AI being the biggest advances this year[6]. Digitalization is one of many structural aspects AI needs before it can be fully deployed. It may be a disruptor now, but once someone figures out how to use it pervasively across an industry, adoption will go very quickly. The secret for any one company is having the structure in place to be a market leader. Many consider generative AI as the tip of the spear.

US Monetary & Fiscal Policies

The passing of a budget with increased funding in some areas will provide some stability in doing business with the government. However, the process is six months behind schedule. Given this is an election year, businesses affected are likely to see a late budget again for next year. The US Government fiscal year starts October 1st. It is too early to tell at this time if productivity will see a bump from a passed budget but if so, it probably will not be enough to spark a wide-spread economic expansion.

Last quarter inflation was an issue, and still is. This quarter I am looking for signs that inflation is waning. Inflation subsiding is desired, but I will take a significant economic expansion with wages rising even if inflation holds at its current level. If the government keeps spending at its current rate, I do not see inflation reaching the established threshold this year.

Things to consider.

Using these factors to look at the industry in which your company competes can help with making versus buy decisions. They can also help decide whether you need to look outside your organization for needed capabilities or invest in more training to prepare your people for what is coming. These factors are also good for helping realize if you are a target for acquisition or in a position to expand through merging. Or strive to differentiate to be a leader.

Commercial Real Estate

CRE is one industry that all four factors can be seen at play. A shift in any one of them can result in industry-wide wins and losses.

I believe we will see an increase in investment activity in CRE due to distressed property performance, especially if the Fed cuts interest rates. PWC analysis of global real estate trends for 2024 states: “We expect more opportunistic funds to raise capital in 2024, waiting for distressed real estate buying opportunities to become available”[7]

The CRE industry has been experiencing a recession like downturn for several years and will not likely see an improvement for a few more years[8]. Going into 2022 M&A activity slowed due to inflation and interest rates[9]. If the interest rate hurdle is lowered, there is a chance this year to see it pick back up again.

The subsectors of CRE are not consistently performing with office space experiencing the greatest difficulty. Office space has not returned to its pre-pandemic occupancy rates. Given the hybrid in-office policies most companies have adopted it will be years before returning to earlier levels. According to the National Association of Realtors[10], there is twice as much empty office space as there is occupied compared to a year ago.

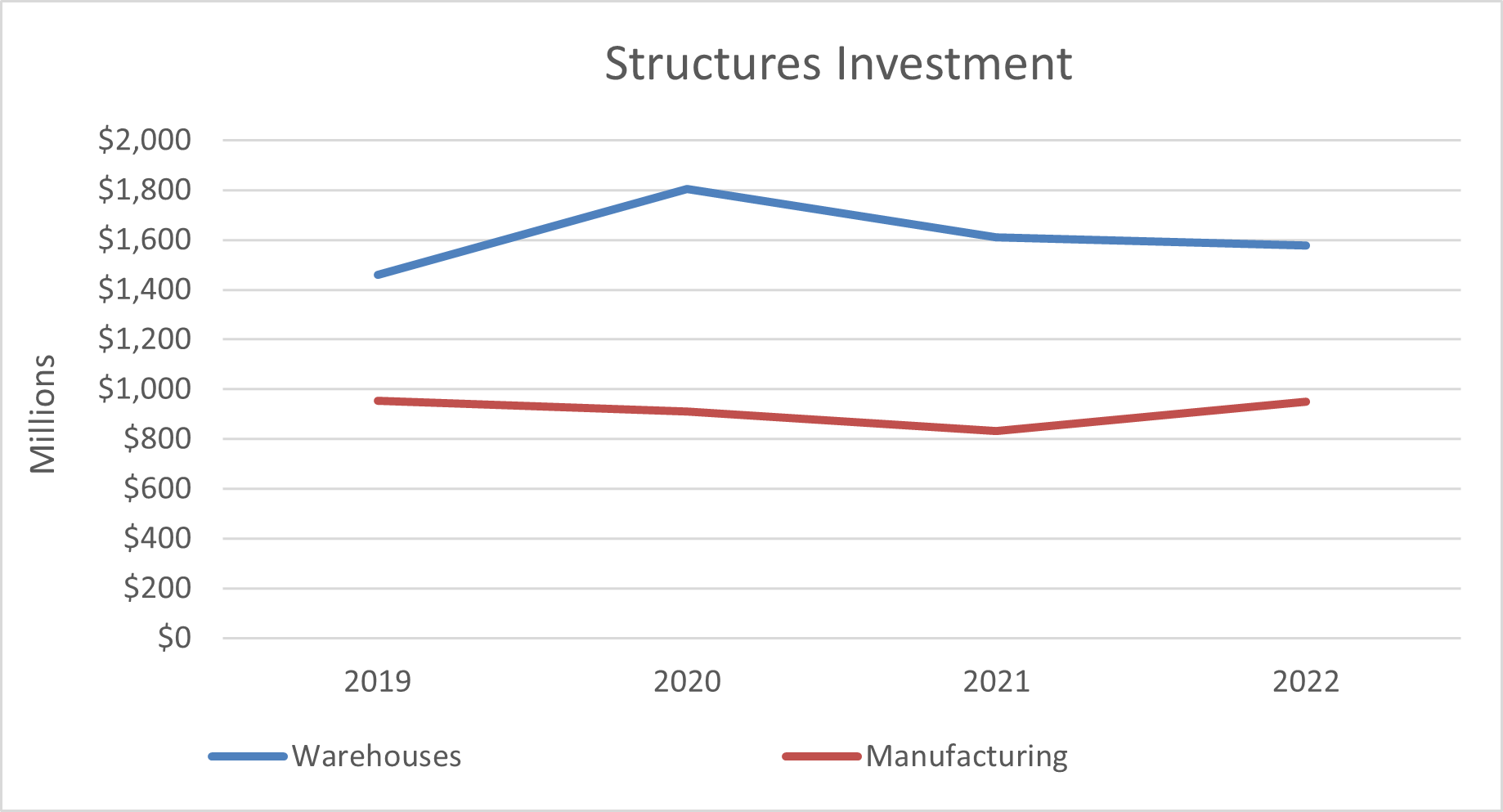

Industrial and warehousing remain resilient but may be reaching a point of saturation.

CBRE predicts investment in real estate will improve sometime during the second half of 2024[11]. Their analysis also reveals retail space is not experiencing the same effects as office space. Retail space, while not seeing an increase in demand, has paced construction with the trends in online shopping.

The least impactful of my factors for CRE, AI still has the potential to increase transactional effectiveness and efficiency within firms. According to Spencer Burton of A.CRE:

AI tools are enabling CRE teams to process vast amounts of financial data, automate repetitive tasks, repackage existing content in more palatable formats, and gain valuable insights that can inform strategic decision-making[12].

Our 4th 2023 Quarterly Insight mentioned Robotic Process Automation (RPA). While that technology has progressed it will take the addition of a learning algorithm (AI) to combine or eliminate more basic transactional work. This gets to the heart of technology’s greatest potential, enhancing people-centered endeavors. Transformations do not happen over night. In fact, they can take years to happen. What people often see is the acceleration of the last few months as activities and results become pronounced, pervasive, and persistent.

[1] ‘Design of Business: Why Design Thinking is the Next Competitive Advantage’, Roger L. Martin, pg. 21

[2] https://www.weforum.org/agenda/2023/03/what-is-a-rolling-recession-economy-news/

[3] ‘A History of American Business Cycles’; Thomas Kevin Swift, pg. 217

[4] Adopted from ‘Good Strategy Bad Strategy: The Difference and Why It Matters’, Richard Rumelt, pg. 199

[5] https://vault.com/blogs/workplace-issues/ai-will-affect-these-industries-the-most-in-2023

[6] https://sloanreview.mit.edu/article/five-key-trends-in-ai-and-data-science-for-2024/

[7] https://www.pwc.com/gx/en/services/deals/trends/real-estate.html

[8] https://datarooms.org/vdr-blog/real-estate-ma-transactions/

[9] https://deloitte.wsj.com/cfo/commercial-real-estate-trends-and-drivers-in-m-a-01660585414

[10] https://www.nar.realtor/commercial-real-estate-market-insights/february-2024-commercial-real-estate-market-insights

[11] An executive summary of their 2024 outlook can be found at: https://www.cbre.com/insights/books/us-real-estate-market-outlook-2024

[12] https://www.adventuresincre.com/ai-tools-commercial-real-estate/