Succeeding in business can feel like steep mountain climbing. The closer to the top, the more difficult it becomes. And being the first one doesn’t guarantee dominance. Competition is right behind you, and they can either overtake your position, or find a more popular ridge. Pathfinders set themselves apart by scrambling for the path that aligns their strategy with market needs. Curiosity focused on creating value.

We endured a different set of challenges this past fourth quarter. Yet the uncertainty and volatility felt eerily familiar. We also saw leaders who fell into two types of behavior: those that were reactionary and those who were adaptable. A common trait among the adaptable is they are comfortable with ambiguity. They are more likely to find a way to succeed. There are literally hundreds of examples of this playing out across every industry.

A Real-World Example

The pizza industry is one of the most public displays of pathfinders and scramblers. Not too long ago Domino’s Pizza bested Pizza Hut in sales[1]. Pizza Hut had previously held the highpoint for nearly 50 years. The industry players and their moves:

- Domino’s Pizza strengthened their delivery capabilities with enhanced technology every step of the sales cycle. They pursued brand awareness backed by a strong supply chain.

- Hunt Brother’s grew their presence through convenience store franchises giving them the top spot in number of locations[2].

- Pizza Hut’s national presence originally came from the expansion of their dine-in experience. This helped them develop consistent quality in the product and service[3].

- Papa John’s has fought for a niche through a perception of superior quality and continually innovates with different tastes[4]. Not enough to continually edge out Little Ceasars but keeping above 5th

- California Pizza Kitchen has a much higher average transaction value[5] (~$28 per transactions compared to the next highest at ~$15). They are not even close to being in the top ten for number of locations or sales but have something worth scaling.

The dominant business model for fast-food pizza is delco (delivery and carry out). Business models are important for competent execution. Yet consumers’ taste preferences, reinforced through brand identity, is what you build a business around. Pizza Hut’s delay in embracing the delco model could be the reason it fell to number two[6]. Or it couldn’t imagine a better value proposition. Currently they are looking for a hybrid of dine-in and delco that doesn’t look promising.

Finding The Best Path

It is easy to get caught up in the trappings of your industry. Most players have adopted delco and streamlined operations. Yet there are indications that more customers can be created by finding a different path. The industry itself holds clues:

- Different types of franchise opportunities; convenience stores, food trucks, etc.

- Quality of ingredients; Papa Johns is the clue but not quite the answer.

- Let’s not forget, taste plays a very large role in keeping customers coming back.

It Is About Discovery

The long slide of Pizza Hut should be a reminder that it is not what made you successful decades ago that keeps you on top. It is the continual discovery of success factors (pathfinding) that applies to any industry. The pizza industry example also highlights the need for leadership across any sector to be aware of their industry limitations, competitor capabilities, and changing preferences (For more on this see: Understanding the Influences that Impact Your Company’s Brand). The pizza industry has also shown that the balance between differentiation and adopting fundamental practices is not an easy task. Making the wrong choice or hesitating can cause you to cliff out into the abyss.

Changing the main context of your situation may foster innovation but seeking an easier market segment will not. Flatter market landscapes are by nature level playing fields. Success is about being adaptable to indicators as they are revealed cresting the next ridge. The economy is a feature across the terrain, but it is the same for everyone in your industry. The key is to know how changes affect your situation.

What is Expected in 2026

We are predicting slower but continued growth. The main drivers of the economy are most likely Technology/AI, discretionary spending, public policy[7].

- The effective tariff rate before 4th quarter 2025 was 10%[8]. It is expected to rise to an average of 15% through 2026.

- The Fed is expected to cut rates by 50 basis points in 2026. Somewhat helping consumer spending but not alleviating price pressures.

- There were technology industry returns for 2025 of 24.6%, enticing continued capital investments in 2026[9].

- Labor will remain weak 1st quarter 2026 continuing the trend in 4th quarter 2025[10].

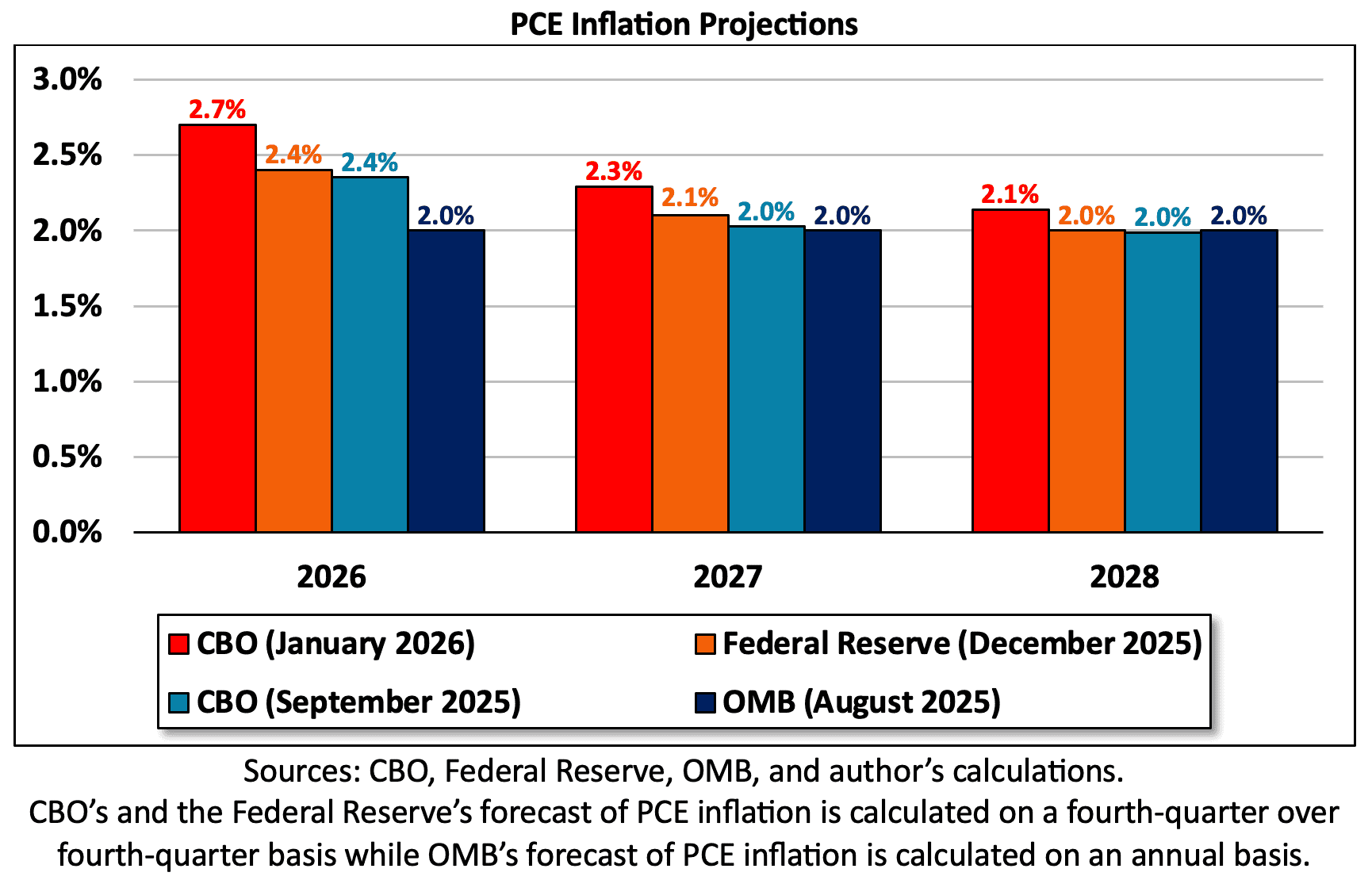

- Inflation is expected to decrease to 2% by end of 2026 (See Figure 1 below)

Aligning the Value Chain

Knowing consumer pain and aligning your business to provide a solution is a classic demand and supply side opportunity. One path is to become the lowest-cost producer but that is a huge supply side swing. Alternatively, you can:

- Develop multiple price points

- Redesign products on a smaller scale to offer mix & match options

- Leverage customer loyalty programs

- Lean into technology to improve quality, cost, and delivery

People remember who was there for them, increasing brand loyalty. It is important to note that ending giveaways could be seen as taking something away. Coupons and promotions often drive cyclic purchasing behaviors.

Things to Consider

Successful companies redesign instead of repeating old strategies. Focused adaptability is necessary if an organization is to survive long-term. Outside of luck, only strategy and innovation can ensure you have a viable path to the top. Even though Domino’s finally overcame Pizza Hut[11], they should keep exploring, beyond menu item trial and error. All business leaders should avoid swapping tactics for strategy because market swings wipe these efforts out.

Trends, rediscovered flavors, alternative comestibles, and changing preferences all contribute to a constantly shifting market. Success is when the market bonds with your brand. It is then scaling that identity using the most effective business model, not what everybody else is doing. Delco is the industry’s result, not the solution.

Staying Number One

What are the chances that Domino’s will have as long of a run at #1?

Things in Domino’s favor:

- For decades Domino’s has been developing its delivery service. At one point they guaranteed 30 minutes or less or a free pizza. Pizza Hut’s dine in service had once given it an advantage, but the franchise continues to fail to transition with the market.

- Supply side factors – supply chain purchasing power that grows with sales.

- Demand side factors – Marketing budget giving them reach and the ability to better understand customers and markets.

- Technology has enabled them to enrich online ordering, order tracking, reward program, and expand globally[12]. Their tech strategy evolved with consumers’ habits. A characteristic of dynamic capabilities[13].

- Franchisee relationships

Things working against Domino’s:

- The next three top national players have assets and capabilities that can be foundational to a quick ascension. This includes Pizza Hut who recently invested $130M[14] to improve its business model.

- The low barrier to entry. Used restaurant equipment is more plentiful and affordable. It also only takes a small kitchen to create the next great new taste.

- Shifting taste preferences.

- Delivery as a differentiator may fall first with 3rd party food delivery services available to any company. Hunt brother’s unique value proposition of selling through convenience stores challenges the delivery model[15].

- Value deals and loyalty programs have a tendency to constrain product quality. Also, the commodity magnet gets stronger with each economic downturn.

Moving Beyond Tactics

The fast-food industry’s repetitive introduction of recycled menu items is a commodity tactic. As I wrote about The Trappings of Success, companies within commodity industries tend to confine themselves to the same technologies, methods, and resources. Not to mention, it is very difficult to scramble from a commodity brand identity.

As successful as Domino’s Pizza has become, it has not created a highly defensible market position. Advertising butts up against value creation, where further investment sees shrinking returns. There is a limit to how long customer loyalty programs can convince people to keep choosing the same food. Any productivity gains to improve margins will eventually be replicated by competition. It is about finding the right combination of taste, technology, and execution. Simply adopting the dominant industry business model may mitigate risk and improve efficiencies but long-term success come from differentiation.

When to start searching for new success factors:

- The current model no longer helps provide a solution for your customer base

- New technologies shift the industry structure or make old methods obsolete

- The industry is so saturated that growing margins are impossible

Once the business model, technology, or strategy are stretched to their limits there are very few options left. If you cannot beat your competition at their own game, change the rules. You will either find a workable niche or blaze a new trail.

[1] https://restaurantbusinessonline.com/dominos-increasingly-dominates-fast-food-pizza-market

[2] https://www.xmap.ai/blog/10-largest-pizza-chains-in-the-united-states-in-2025

[3] https://www.qsrmagazine.com/story/the-evolution-and-modernization-of-pizza-hut-continues/

[4] https://www.franchisechatter.com/2014/11/03/battle-of-the-brands-which-company-is-more-worthy-of-franchisees-investment-dough-little-caesars-or-papa-johns/

[5] https://aaronallen.com/blog/pizza-industry

[6] https://www.foxbusiness.com/lifestyle/pizza-hut-close-around-250-locations

[7] https://www.deloitte.com/us/en/insights/topics/economy/us-economic-forecast/united-states-outlook-analysis.html

[8] https://www.deloitte.com/us/en/insights/topics/economy/us-economic-forecast/united-states-outlook-analysis.html

[9] https://www.investing.com/analysis/the-sp-500s-topperforming-sectors-3-lead-the-pack-in-2025-200672739

[10] https://www.deloitte.com/us/en/insights/topics/economy/us-economic-forecast/united-states-outlook-analysis.html

[11] https://www.foxbusiness.com/lifestyle/how-dominos-regained-its-crown-pizza-industry

[12] https://www.proserveit.com/blog/technology-framework-and-roadmap-dominos-story

[13] Is Your Strategy by Design or Chance? – Driscoll Solutions

[14] https://www.qsrmagazine.com/story/the-evolution-and-modernization-of-pizza-hut-continues/

[15] https://www.themarketingsage.com/wow-an-800mm-pizza-chain-hidden-in-rural-c-stores/