A Mid-Year Validation

A time to verify closely measured signs of progress, stalling, or a warning against negative consequences. The halfway point is common for performance reviews, strategy meetings, and proving decisions about the future are still valid.

Leaders should be noting not only their company’s current performance but also that of their market and target market. During business cycle troughs, benchmarking competitors is useful in understanding how they are handling the pullback in customer spending.

Verifying Strategic Intent

No time like the present to assess the assumptions made about target markets and S&OP goals.

Economics, industry, and competitor elements are constantly changing where knowing the magnitude, persistence, and breadth of what you are experiencing can tell you what, if any actions need to be taken.

The balance between ensuring employee alignment of effort in fulfilling the promise to your customers and achieving your strategic choice needs to be actively managed. In times of little to no growth, where strategic choice is still valid, better managing internal processes and assets can improve profits and sales.

Economy, Industry, and Offering

What purchasing power parity for a basket of goods allows consumers to put more in their basket? From a company’s point of view, now is a suitable time to know what category their offerings are perceived: Essentials, normal, or luxury. The income elasticity of demand shows not only how much more or less consumers will demand your offerings. It can also help show how markets will recategorize your products or services based on changes in income or inflation. Business leaders should work to quantify these for their industry. While pricing is important, it is only one of several ways to help with proper market placement. Is there a difference in the type of product or service you have and how the market is treating them?

Pettinger writes about phenomena to look for[1]:

- Demand for Inferior goods will decrease with a rise in income.

- Necessity goods may increase with a rise in income, but the point of diminishing return happens quickly.

- Complementary goods may drop off if their cross-product increases in price or wage growth drops.

- Substitute goods demand can increase if the alternative product price rises.

- Veblen (Snob) goods’ sales increase with price. As an example, the Olay brand experienced this when its price was increased from $12.99 to $18.99 per jar.[2]

- Comfort or Giffen goods are when a product becomes preferred because inflation turns a staple into a luxury.

- There are also Merit and Demerit goods. Those goods whose buyers have yet to know or recognize benefits and detriments; respectively.

When customer demand changes or economic conditions shift, quickly adapting is crucial. Decisions made from a transactional cost or even resource-based view of the firm not only take too much time to implement, but thin markets make finding talent, assets, and resources impossible.

Using the first principles of product management can help your organization become more agile in response to changes in demand, industry, and the economy. Brandon Chu believes focusing on maximizing the impact to your company’s purpose and working through others to get everything done.[3] Two principles I believe apply to every aspect of business.

Effective Implementation

Objectives are the most crucial factor when considering changes. Initiatives must be based on strategic intent or purpose of the business. Improving for the sake of improving is not only a shallow effort that your employees will see right through but could also put you further off course.

The reason objectives are so important is because not all improvements have the same effect. It is not just choosing between one type of improvement over another. Even within each type, there are a variety of outcomes.

Productivity for example can yield more in the same amount of time or require less time to make the same amount. Reducing the lead-time in an insensitive market deflates the sense of achievement. Lowering costs can be used to lower expenses keeping prices the same. This can also be used to create multiple price points, or simply lower the price. Luxury producers often push price to the back of their minds, but many have created entry level products to grow with customers’ affluency. It is also important to know if consumers prefer quality improvements to make your offering last longer or be more robust.

Without the context of strategic choice or purpose, these improvements become equally weighted menu items. Often myopic improvement initiatives create results your customers are not willing to pay for. Improving in isolation not only eats up your time and resources but also provides an in for your competition.

Talent

We are all aware that finding enough qualified people has been difficult these past few years. Leaders are finding new ways to develop the people they have through in-house training programs, tuition reimbursement, and establishing skills blocks. What has really hit home with me these past four years is versatility has become a virtue. Being proficient in one or two methods is no longer sufficient. To remain competitive, leaders must develop employees to sense when current methods will not work on the next challenge. Widespread employee abilities must go beyond processes where policies, business models, organizational design, to adapting mental models are expected to be in play. The plateau of achievement for being first to market has shrunk and the benefits do not last long.

In the early 2000’s we saw how rapid changes in fiber optic technology nearly wiped out an entire industry. Did Corning jump too soon to be the first with fiber optic hardware? Committing resources to the first solution when you are not in control of the market makes you a follower, not a market leader. Committing substantial assets and resources as a follower in a very dynamic market spells disaster.

The fiber optic story and many others prove how an exploitation mindset can blind entire industries to what clients actually want or need. The awareness that comes from intuition or sensing can originate from anywhere in your organization. The ability to explore latent demand or shifts in needs comes down to the individuals in your company. Developing people requires well communicated expectations, purposefully observing behaviors, and fostering understanding between management and employees.

The US culture of getting something to market and using consumers to direct efforts in improvement is more of a losing proposition each year. The answer is not going to be in adopting methods or programs wholesale. For an organization to remain competitive, employees must develop the ability to sense the need for change and question existing heuristics for feasibility.

Instead of running one type of problem-solving method to perfection, winners will have employees who understand the principles of problem solving and can adapt or develop a framework to fit the situation and context. Creating a framework ahead of time and expecting employees to become experts in it is pigeonholing your ability to compete in a very narrow space. It is not whether A3 or 8D is the superior model, but which one is right for the job at hand.

There are no business systems you can adopt to put your organization ahead of all the others. There is only what and how well your culture develops as it faces challenge after challenge.

Internal Consistency

Organizational identity is a thing. It is not only how employees perceive the organization but also your industry, competition, and customers. Versatility is important not only for creating value, but also your company’s ability to innovate. Identity provides your employees with two essential motivators: belonging and certainty[4].

What are you known for by your customers and how are decisions made within your company. Alice Lam writes how structure, cognition, and change/adaptation determine an organization’s ability to innovate.[5] In all three paths for innovation, it is the ability to adapt to challenges in new ways, not to get better at your current approach.

Standard work and existing methods provide reliability, but they also need to be a point in which to pivot from. The role of leadership is to develop the most valuable organizational design, business system, and policies based on meeting shocks and anticipated shifts. For more on organizational identity read: Understanding the Influences that Affect Your Company’s Brand.

Things to consider.

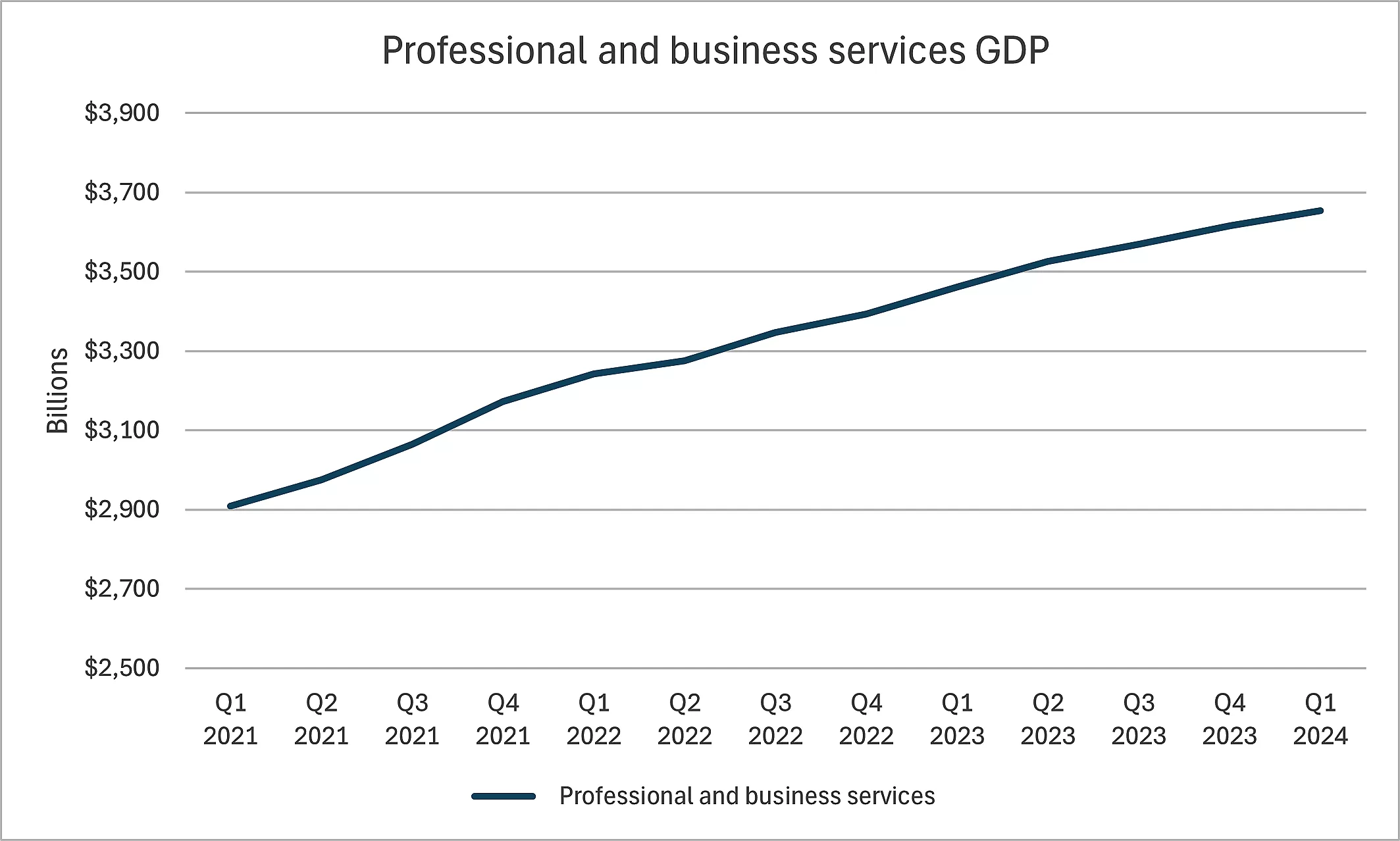

What do you do when your industry or one that compliments yours is declining? Services is the largest US sector and has been declining since fourth quarter 2021. According to Bloomberg news it has shrunk at the quickest rate in five years: US Services Activity Contracts at Fastest Pace in Five Years. Figure 1 shows the GDP of Professional and business services increasing at a 1.9% rate from Q1 2021 through Q1 2024. Not a significant improvement for the largest industry in the U.S. economy but a positive sign, right?

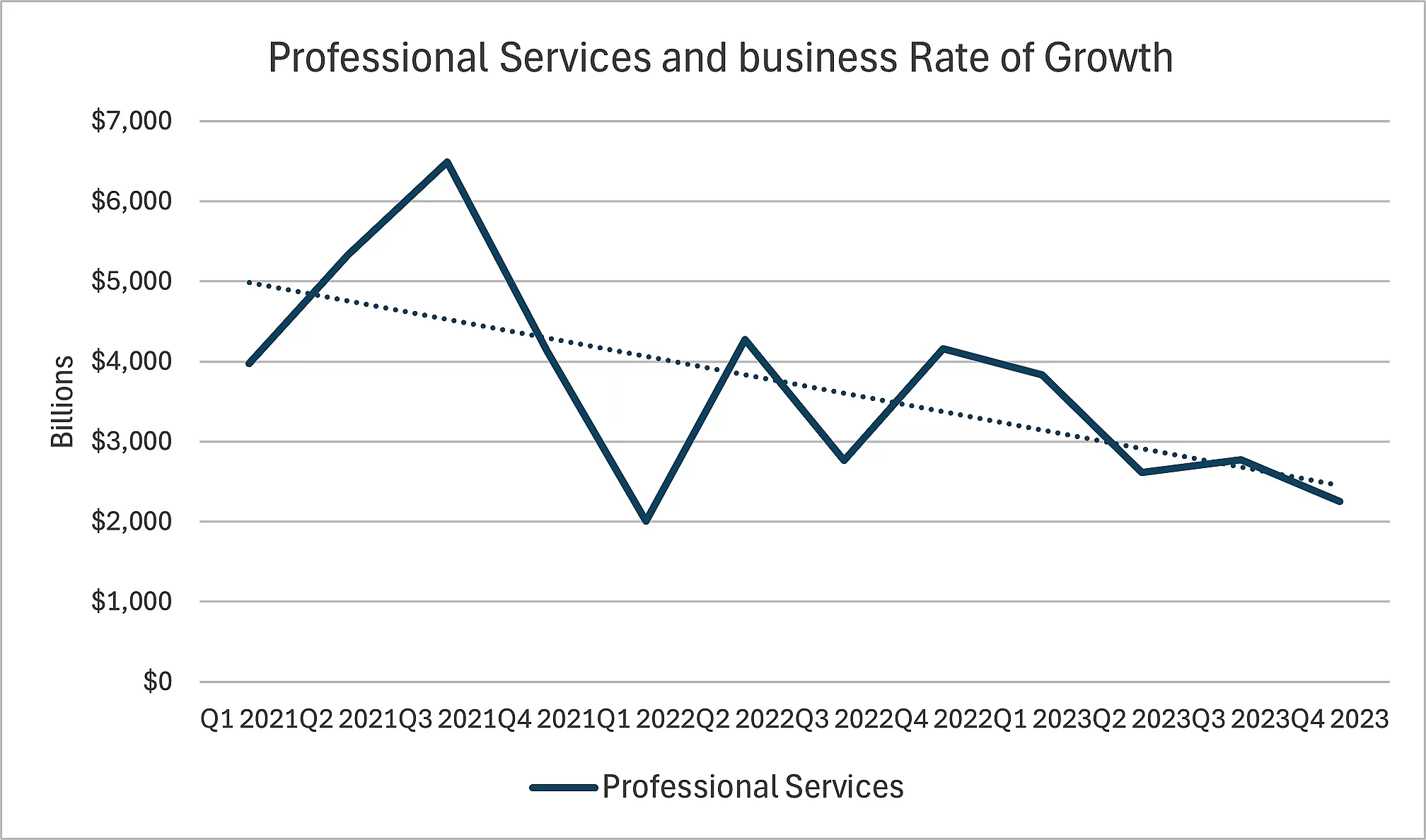

Over that same period, the growth has been slowing; Figure 2. While this is a broad view of one industry, not all subindustries will be experiencing the same growth or even rate of growth. For example, during the same period, Legal services saw the slowest growth at 0.9%. Miscellaneous, professional, scientific, and technical services saw the fastest growth at 2.5%. Legal services is less than 10% of total professional and business services GDP, but the sluggish growth and the slowing rate of that growth feels very real to people working in that industry.

This Legal services industry scenario is one where worthwhile growth comes at the expense of competitors. Reputable firms are not going to goad potential clients into litigation and over-billing is something clients are more sensitive about now than ever.

When you find yourself in the same situation as Legal services your best options for growth are M&A, expanding or developing complimentary services, or creating multiple price points. The go to of productivity improvements for all that ails you will take your company backwards.

[1] See: https://www.economicshelp.org/blog/790/economics/different-types-of-goods-inferior-normal-luxury/

[2] ‘Playing to Win: How Strategy Really Works’, A.G. Lafley and Roger L. Martin, 2013, pg. 15

[3] https://blackboxofpm.com/the-first-principles-of-product-management-ea0e2f2a018c

[4] https://www.exceptionalfutures.com/organizational-identity/

[5] https://www.bbvaopenmind.com/en/articles/innovative-organizations-structure-learning-and-adaptation/