Strategy and Budgets

Do you fall into the camp of using staff meetings in third and fourth quarter to set next year’s budget with strategic objectives based on what you can afford? Or do you base your budgets on strategic choices and customer performance gaps? There may be some back and forth between strategic intent and budgeting, but one of the two scenarios starts the process.

I believe there are four categories leaders should spend the vast majority of their time and money on (as they are developing their people):

- Enabling the improvement of why customers currently buy from you

- Realizing strategic choices that competitors cannot or will not challenge you

- Efforts to achieve optimal fit across functional departments and

- The culture to deliver

Economy

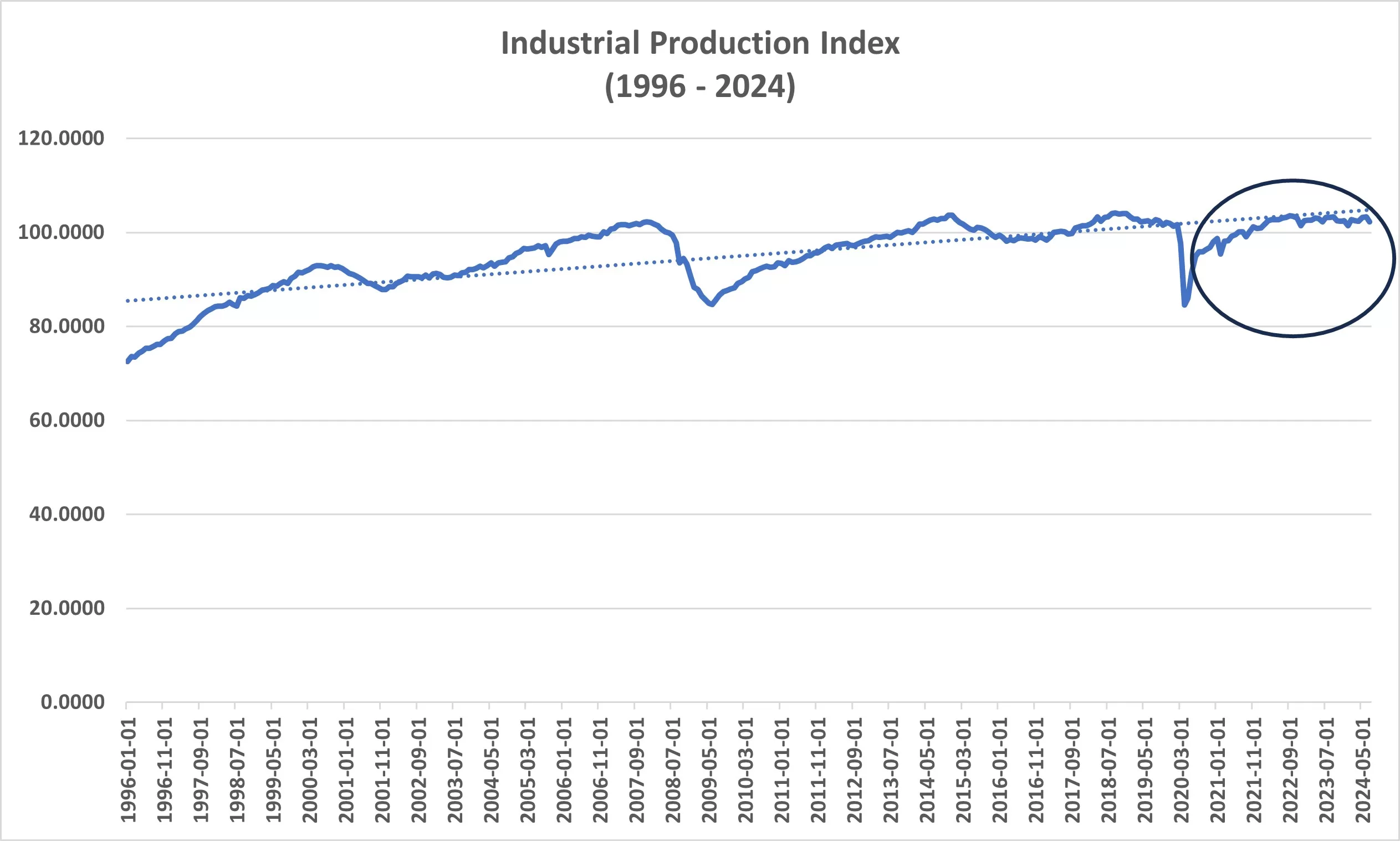

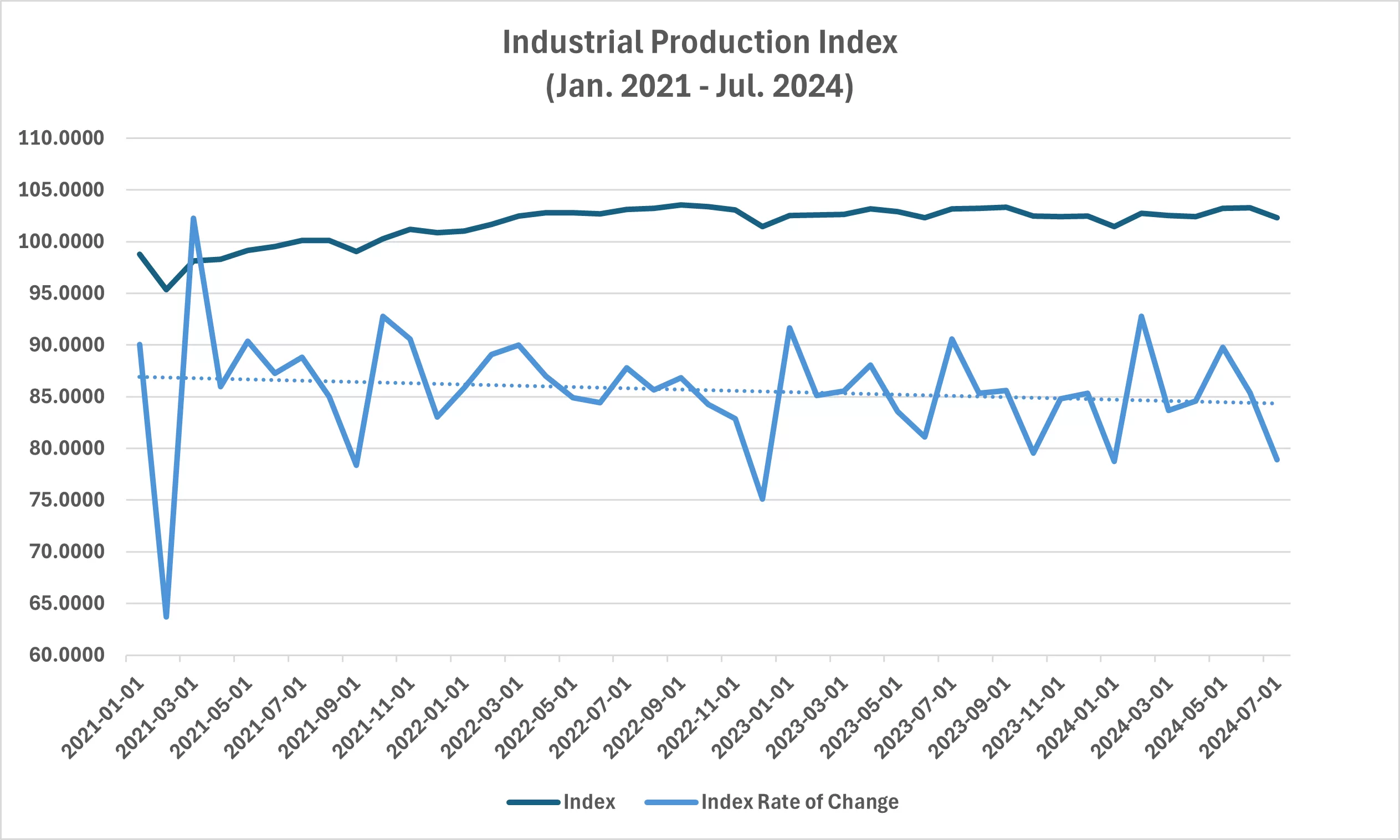

The recent 50bps rate cut did not have investors or business leaders jumping off the sidelines. Productivity is still the best indicator of an economic expansion. As you can see from the below graphs (Figures 1 & 2), Industrial Production has tapered off from January 2021 through July 2024. Compared to January 1996 to July 2024, the rate of growth has become slightly negative.

We will have to wait for October’s numbers to be published to see the significance of this. However, this is when I look for signs elsewhere to get a sense of what may lead to more productivity. The inputs to productivity can provide clues: durable goods, employment, etc.

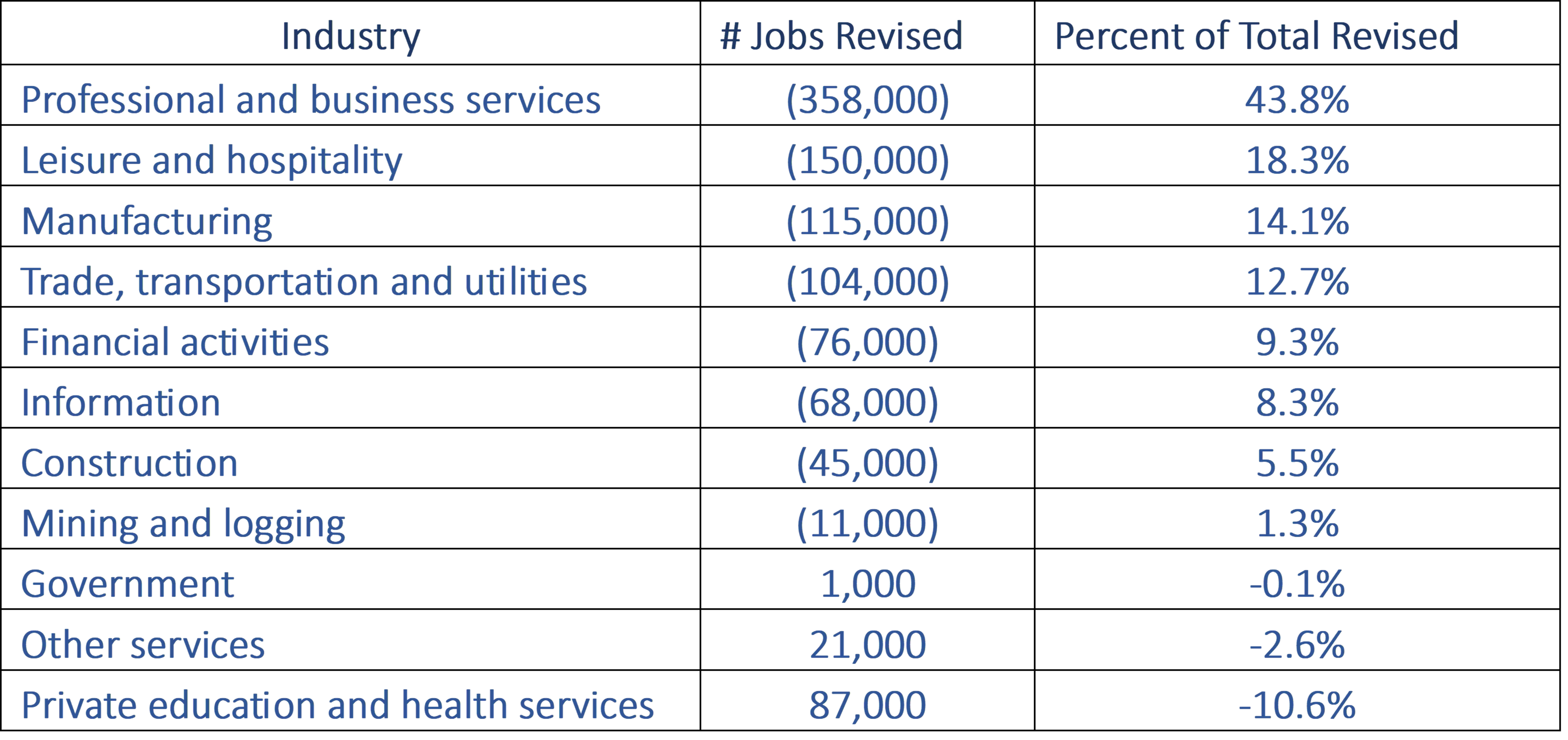

When people ask me, what sensing looks like, recent examples work best. Let us look at the revision of the 2nd quarter employment numbers.

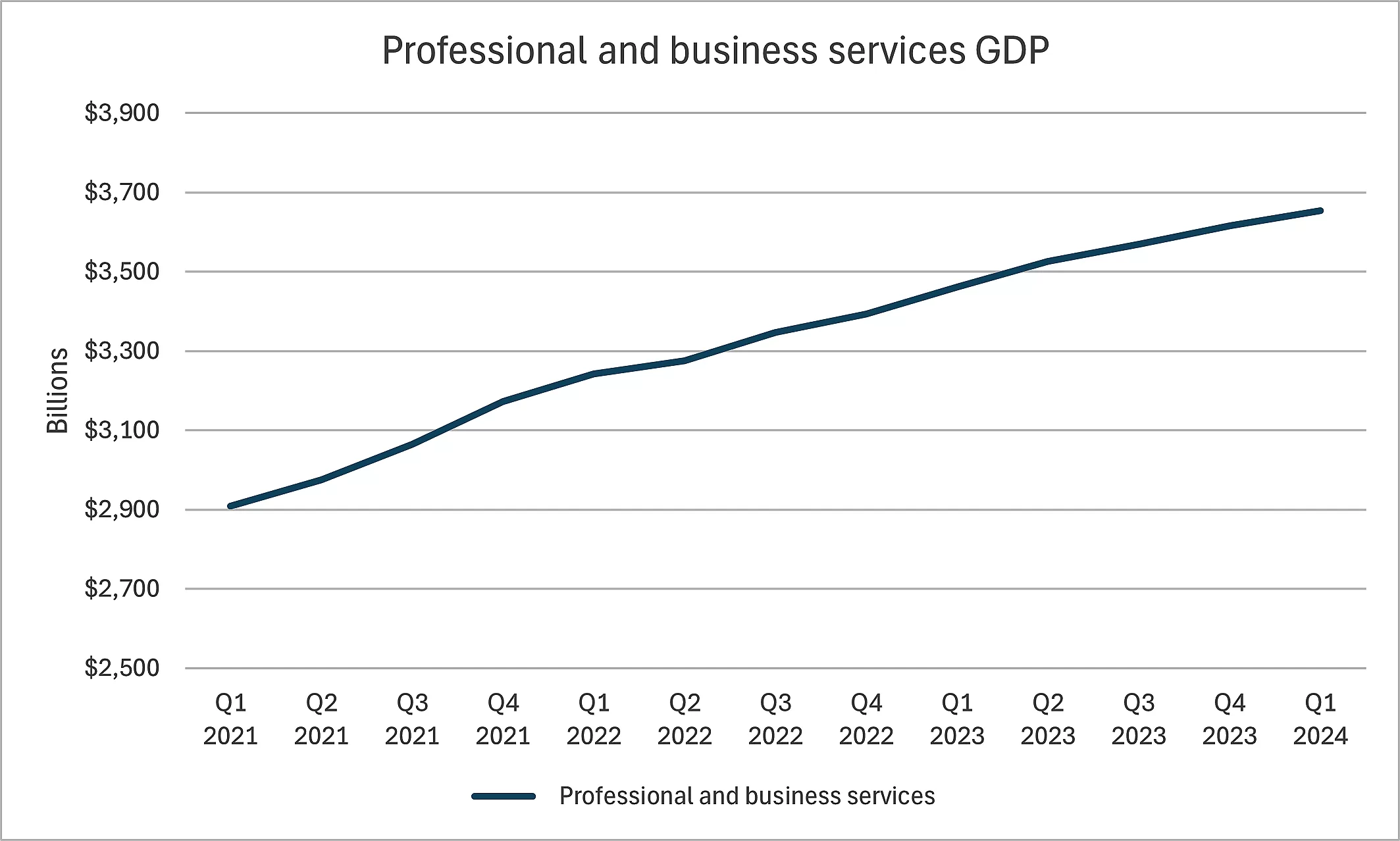

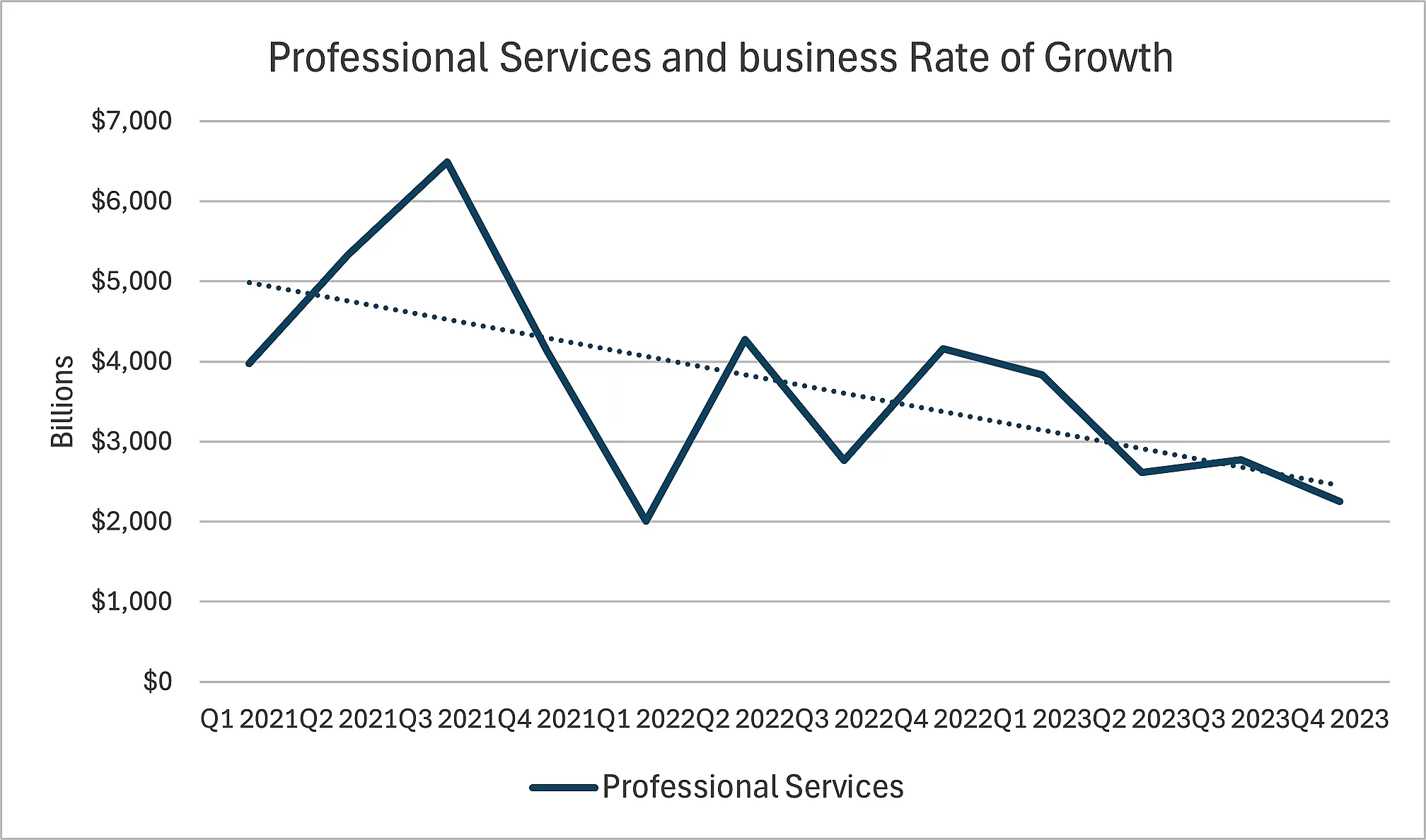

What has been your experience with the industries in the table above? In the 2nd Quarter Insight, I used Professional and business services as an example of how the rate of change offers more insight for sensing than period over period trends. I have included the graphs in the appendix for reference.

My industry classification is Professional and business services. I noticed a change in the market 4th quarter last year. I sensed that something was off even though data showed the industry was still growing. This led me to investigate. Several sources confirmed what I was sensing: ie. Job openings, news of consulting firms laying off or deferring job offers, an influx of inquiries asking me if I needed help with any projects, and more consultants making ‘Open to Work’ announcements on LinkedIn.

What is Sensing

Sensing is a notion that things are not as they seem or might be different. You get great customer reviews, but revenue does not seem to reflect the numbers. Something you notice could be the customer timing in responding to a proposal. Sensing can occur at any level in the organization. Being able to improve based on hard numbers is easy, but creating the environment for employees to escalate notions is almost unheard of.

You certainly do not want people to make changes on a whim, but how do you encourage exploration while also being aware of the risk of perceptual bias? This is the proverbial ‘fork in the road’ between reliability and pursuing validity. When you are faced with divergent paths, as Yogi Berra famously said, “…, take it.” Leaders must drive best practices to standardization AND enable discovery of new ways to delight customers.

So, what policies or guidelines can you use so the ideation happens?

Functional roles must adopt capabilities that may appear to be contradictory. For example, finance should still advise on the development of budgets and monitor variance for routine activities. They must also use methods that foster entrepreneurship similar to venture capital investors when teams are exploring. VC’s make sure the environment is suitable for innovation and the right resources are available, at the right time. They also establish criteria for funding rounds. Tolerance for risk and sunk costs should be agreed upon ahead of time.

Organizational Identity

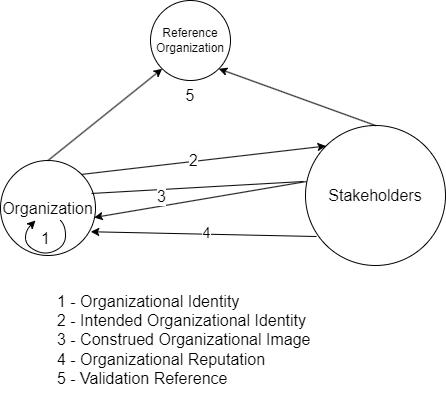

It is not only how employees perceive the organization but also how industry, competition, and customers view it. Knowing what primarily drives value creation decisions goes a long way in creating a critical path for novel solutions.

Internal Alignment to Market Expectations

It is important that employee efforts align with the company purpose and strategic choice. Without both, you run the risk of creating the perfect offering that satisfies very few. Or you lose too many customers before delivering what creates the most customers.

In other words, functional dominance can steer efforts away from what the market needs or wants the most. Adopting productized solutions like Lean or Six-Sigma often becomes the pseudo voice of the customer. Worse, these productized solutions can assume strategic choices by ignoring where to play and how to win.

Victoria Wilson writes “Organizational identity is the high-level, shared perspective of an institution’s purpose, values, and culture. In other words, it is the “why” behind what you do and how you do it and the code of ethics that guides behavior among every member of the organization.”[1]

Leaders cannot control culture, but they do have a great deal of influence through policy, being present, and role modeling expected behaviors. Through opportunities to engage, leaders can discuss “why” the organization works the way it does and gain insights into how employees view their company. These opportunities can be working sessions, staff meetings, performance reviews, and open forums.

Understanding External Identity

Stakeholders will each form their own belief of what your company represents in terms of how it affects them. Ways to better understand how the world views your organization include capturing the voice of the customer, understanding your suppliers’, and having a reference company to benchmark. It is sometimes easier to have a conversation with a stakeholder about another company than it is to get them to ‘open up’ about yours.

Once a clear understanding of your construed image and reputation is documented, flesh out a persona from your own employees. I’ve simplified this process by limiting how employees identify with their company. I call it functional dominance and ask people to tell me what kind of company they work for: Marketing, Sales, Customer Service, Engineering, Operations, or Supply Chain (Read more on this here: Understanding the Influences That Impact Your Company’s Brand.) I got a realistic response from a senior leader of a very large pharmaceutical company. He stated they are a sales company.

Another way to phrase the question is to offer the categories I have adopted from Kaplan’s strategy map: product leadership, operational excellence, customer intimacy. Many companies are good at a combination of the two or more but excel in one as far as customers are concerned. Read this article by Fast Company for how operations can be a source of strategic innovation: Don’t skimp on your company’s operations

Things to Consider

Artifacts of days past

Most of the organizations I am familiar with have remnants of wholesale attempts at improvement. They may no longer be using Lean or Six-Sigma as the ‘tip of the spear’ but the tools and methods are still in use across the company. If you have not done so now is a good time to see what stayed with your culture.

What did they find useful and did they use the tools or techniques in achieving a best practice. This is not an exercise in what should be standardized across the company but how your culture maintained focus on what was important. Their ability to pick the right tool for the job within the right context and advance performance in one or more areas.

Employees sat through all the training, were observed and rated on how well they followed the overall program, and then waited until management’s focus went elsewhere. Who were the ones that ‘cherry picked’ what they wanted and discarded the rest?

Something New

Your employees are using AI. It may not be formally adopted but it is there, and some make effective use of it. Luckily, no one has developed a productized solution around the use of AI… yet.

AI is a recent invention in need of innovation to find the best applications. This is a fantastic opportunity to not only flex your sensing capabilities but to identify what your employees are sensing. How many have tried AI? How much do employees interact with it and how has it made their jobs easier? More productive? What do they see as the best use of it.

Appendix

[1] https://www.exceptionalfutures.com/organizational-identity/