Grow or Die

Must companies grow to avoid dying? The saying turns out, is only true some of the time. What is an absolute truth though, is all organizations must “do or die.” Doing nothing is not an option. By doing nothing an organization has little to no defense against the internal and external forces working against them. There are choices other than growing which focus on improving efficiency, effectiveness and viability. These alternatives aim at improving how assets are used, minimizing costs, and governing resources.

Surviving to Maturity

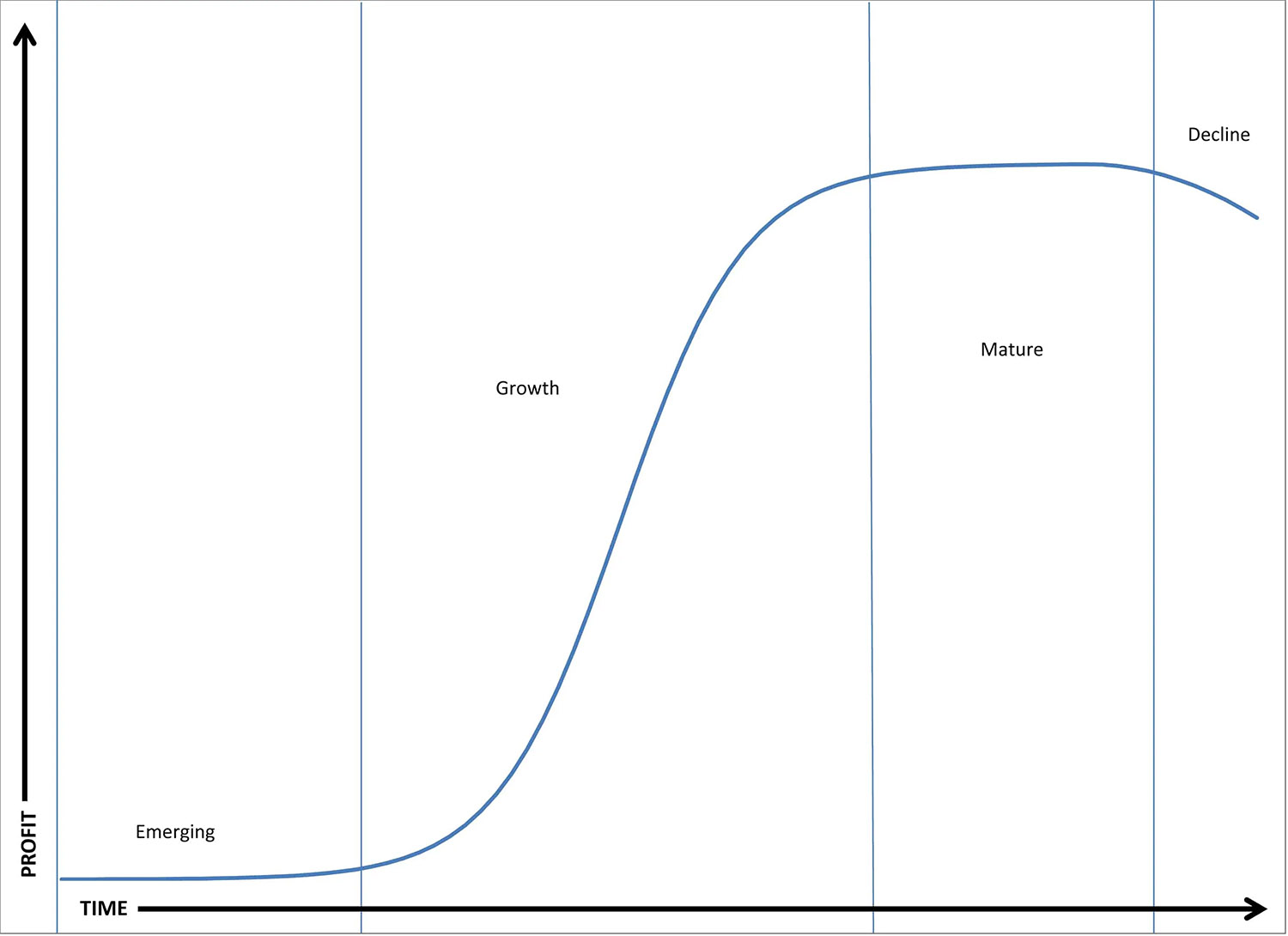

Once a company reaches a mature phase, it could last several decades before experiencing decline. Figure 1 shows a generic maturity curve that a business will go through if it can manage through the many challenges. To avoid decline, there should be a constant focus on staying relevant. Whether this is refreshing the brand or evolving products/services. Sometimes it’s necessary to redesign the business model. This often involves innovating in one or more sub-systems. Like HR, R&D, Operations, or Supply Chain. Sometimes a change in purpose is required. There are several companies today that are only the same in name. For example, Toyota hasn’t always made cars and Wells Fargo wasn’t always a bank.

Emerging is About Growth

In the beginning companies must focus on growth to survive. If costs are not kept in control though, leadership will find it very difficult to consistently deliver to existing customers, let alone handle more. Many businesses continue to grow because they don’t know what else to do. You may know of a few companies like this. They spend more time and money to attract new customers than keep the ones they already have. Do you feel like you must switch suppliers every couple of years to keep getting a good deal?

Improving Along the Way

Without continually improving processes, companies will experience a short maturity with an early decline. Productivity improvements enable growth, but growth does not enable productivity. In addition, all businesses are constantly fighting what Michael Porter calls the Five Competitive Forces [1]. With these five forces (New entrants, Competition, Substitutes, Suppliers, Customers) working against you, growing market share, and maintaining a healthy net profit is very difficult. Keep track of functional dominance as you grow and look for those things that can reverse progress.

In addition to Porter’s five forces there are several other challenges. The overall economy and legislation can be challenging. Sometimes companies cause problems by introducing a new product or service that “cannibalizes” existing sales. With all these things working against businesses, there are still more ways to keep a business going than there are that cause it to fail. In fact, I believe there is only one controllable thing that can cause a business to fail: not making the hard choices. Companies can market product/services by co-branding, private labeling, re-purposing the product/service to move into adjacent spaces or fulfill a need as a substitute. Productivity improvements can reduce lead-times providing an advantage over slower competitors. Improvements can also lower costs and increase capacity to service larger buyers. Innovation can improve value above the industry norm, enticing new customers or modify products/services creating multiple price points.

Figure 1: A Generic Maturity Curve

Scale and Scope

Understanding the economics of your business and industry can provide guidance in output and capital at each stage of maturity. There is the combination of fixed and variable costs within each industry that provides for an optimal cost structure ensuring the lowest long-run total average cost while satisfying demand. Economists refer to managing fixed and variable costs as taking advantage of economies of scale and scope. This is important because having too much or too little capacity can lead to limited cash flow or an inability to meet demand. Not having the right balance of capacity at the right time has played out in many industries with devastating consequences. Profitability is a result of managing fixed and variable costs.

Scale

Economies of scale means having the right amount of assets to fill customers’ orders while at the same time not paying for idle resources. For example, if you rent on average 5 pieces of equipment a month but have 10 on hand then you’re paying for 5 without the benefit of the sales to cover that cost. Competition helps ensure that customers are not paying for excess capacity. Even though they have a zero balance sheet value, fully depreciated assets still have a cost to owning them.

It’s not easy to determine how many companies an industry can support at one time but the limit is usually reached when the only gains come from someone else’s loss. There are also economies of scale external to a business that has to do with shared infrastructure, legislation or skills. Companies can influence external economies of scale by partnering with local community colleges to meet unfulfilled skills or support legislation that makes trade more advantageous for their industry.

Scope

Economies of scope are realized when two or more products/services are cheaper while sold or made together. It could be because materials are better utilized when making two or more similar products. It could also be because two or more products/services are complimentary, and customers prefer to purchase them together.

A Case in Point

Berkshire Hathaway is a case in point that provides a real-world example of longevity without growth, on a very large scale. Berkshire is clearly growing in sales and net income every year based on a growth strategy of acquiring or investing in well-established firms. As with most mature firms, organic growth doesn’t come easy. As published in Berkshire’s Annual reports, most of their growth comes from acquisitions [2].

If Berkshire couldn’t find any more acquisition targets, would they die? Warren Buffet doesn’t think so. He believes that the competitive nature of the subsidiaries, if no more acquisitions are possible, will allow them to maintain their market share and provide healthy cash flows for decades to come. Significant improvements could possibly be made to any one of the subsidiaries, but Berkshire doesn’t seem to believe in interfering with a well-established brand. There will certainly be maintenance costs but it appears no major change initiatives or significant investment would be needed.

Every Year Look to See if Growth is the Right Strategy

Organizations don’t have to choose growth as a strategy. Take the time to decide if growth is right for your company each and every year. First, determine how mature your organization and industry are at the moment. Next, decide if it makes sense to renew growth as a strategy. If so find the right growth that makes sense to your business. If growth isn’t currently an option then look at what you can do to improve product or service value and productivity.

[1] Harvard Business Review ‘The Five Competitive Forces That Shape Strategy’ by Michael E. Porter [2] For example: Over half of the revenue increase from 2014 to 2015 of 8.3% is attributable to the acquisitions of the Van Tuyl Group and AltaLink L.P. Source: Pg 49 of the Berkshire Hathaway 2015 Annual Report.